- Key Survey Insights

- Concerns Around Job Security

- A "White Collar Recession?"

- Worries Surrounding Workplace Culture

- What's Troubling Working Parents

- Personal Finance

- Methodology

The Harris Poll: Recession Watch and Workplace Behavior Snapshot

According to the Recession Watch and Workplace Behavior Snapshot commissioned by Justworks, many employed adults are changing their workplace habits as they determine how to prepare and move forward during these uncertain economic times.

Key Survey Insights

The potential for a recession, worsening company culture, and layoffs are raising red flags for employed adults in the U.S. Just a few months ago, trends like the “Great Resignation” and “Quiet Quitting” were top concerns. However, the dynamics between employees and employers has changed very quickly in the face of uncertainty in the financial markets and the job market.

The Harris Poll survey of over 1,000 full time/part time employed adults in the U.S. revealed…

Over two in five U.S. employees (42%) are worried about getting laid off due to the looming recession.

More employees worry about worsening company culture (52%) than getting laid off (42%).

Employees are taking action with their finances to prepare for a recession with 50% reducing their spending, 38% putting money into savings, 31% taking money out of savings, and 27% saying they have started a side gig or side hustle.

Concerns Around Job Security

Although the U.S. unemployment rate was at record lows in January, the threat of layoffs seems to present workers with the stressful choice between reinforcing the value they provide in their current role or facing a sparse job market.

Some are doubling down on ensuring they are providing value in their current role.

- 47% say they have changed their behavior at work to avoid being laid off during the looming recession.

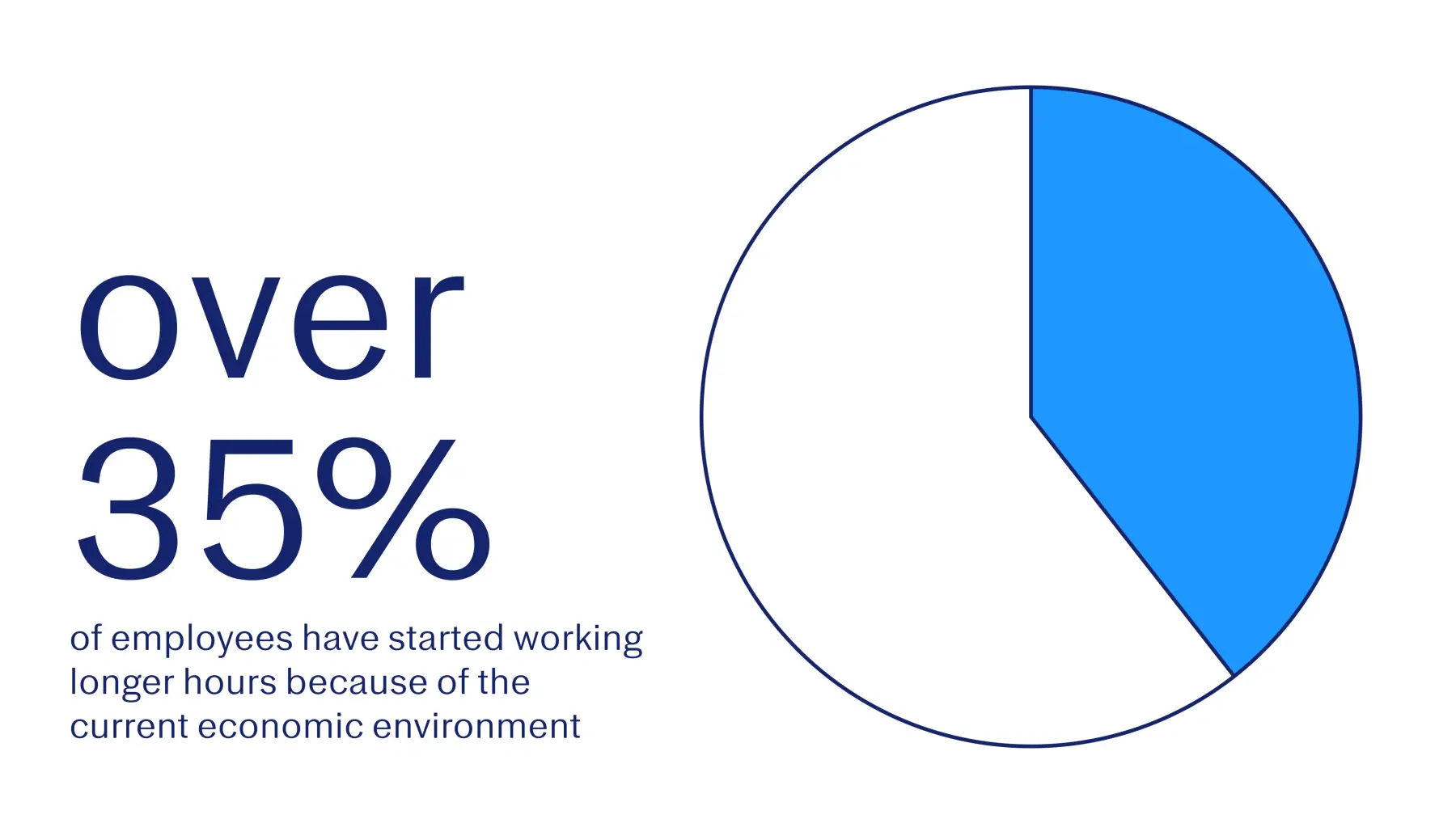

- Over a third (35%) have started working longer hours because of the current economic environment.

- Interestingly, the youngest workers (43% of 18-34 yos and 39% of 35-44 yos) were the most likely to have worked longer hours because of the economic environment (compared to 31% of 45-54 yos, 21% of 55-64 yos, and 18% of 65+ yos*).

- Others seem to feel that increasing their skillset will provide them with more job security, with just under one in five saying they’ve learned new professional skills (19%) or considered additional schooling (17%).

*Note, base size <100 for employed adults aged 65+

Others are more resigned to the job search and are preparing accordingly by taking steps such as updating their resume (28%) or actively applying to jobs (24%). 66% of employed adults are open to or actively looking for a new job.

Yet, even for those who might be willing to undergo a job search, the job market is seen as more daunting than before this economic downturn. Due to the current economic climate, half of U.S. employees (50%) feel they have fewer job opportunities available to them, and 10% say they have stopped looking for a new job.

A "White Collar Recession"?

White collar workers, defined as those whose work is traditionally performed in an office, cubicle, or other administrative setting, are more worried about certain aspects of the looming recession, particularly their negotiating power in the current job market.

White collar workers seem to be experiencing heightened impacts of the current economic environment compared to other workers.

Three in five (60%) are worrying that they will not be getting a raise compared to just over half (53%) of non-white collar workers.

White collar workers are more likely to feel that they have less leverage to ask for a raise now than before the looming recession compared to non-white collar workers (59% vs. 52%).

Nearly half (47%) worry about getting laid off compared to just 38% of their counterparts.

Given this heightened worry, it’s no surprise that white collar workers are more likely to be actively looking for or open to a new job than other workers (71% vs. 61%) – including over a fifth (22%) who are actively looking.

Despite being more likely to be looking for a job, these workers are more likely to strongly agree that they have fewer job opportunities available to them due to the looming recession (21% vs. 13%) and are also more likely to feel a loss of salary negotiating power when applying to new jobs compared to before the current economic climate (60% vs. 51%). Perhaps as a result, these workers are also more likely to sense certain culture impacts – such as coworkers being more competitive at work now than before the looming recession (51% vs. 42%).

Worries Surrounding Workplace Culture

Perhaps due to the efforts many employees are making to ensure their job security, work culture seems to be suffering – and workers are noticing.

In fact, employees are more likely to be worried about worsening company culture (52%) than getting laid off (42%)!

Nearly half (46%) say that their coworkers are more competitive at work now than before the looming recession, and a similar proportion (44%) say they are worried about working longer hours due to the current economic climate. Additionally, nearly half (48%) say they are worried about a reduction in offered benefits or perks at their company – which signals that the culture issues may extend beyond just the competition among employees.

And, workers at larger companies are more likely to sense certain negative culture shifts in their work environment than employees at smaller companies. Workers at larger companies (100+ employees) are more likely than those at smaller companies (<100 employees) to be worried about worsening company culture (54% vs. 46%), Reduction in offered benefits/perks (51% vs. 43%), and are more likely to agree that their coworkers are more competitive at work now than before the looming recession (49% larger companies vs. 41% smaller companies).

What’s Troubling Working Parents

Potentially due to the evolution of remote and hybrid work, working parents are more worried than employees without kids under 18 about the looming recession. The majority of working parents are looking for better employment options in 2023 even though they’re worried that there are fewer jobs or opportunities they are qualified for.

Working parents' top recession fears (in comparison to employed adults without kids under 18) include:

Worsening company culture (56% vs. 48%)

Reduction in offered benefits/perks (54% vs. 44%)

Reduction in salary (51% vs. 42%)

Working longer hours (50% vs. 39%)

Getting laid off (48% vs. 38%)

54% of working parents with children under 18 have changed their behavior at work to avoid being laid off, compared to 40% of employees without kids under 18. 40% of working parents reported working longer hours because of fear of the looming recession, vs. 31% of employees without children under 18.

Among working parents, 72% are actively looking, or open to a new job compared to 61% of employees without kids under 18. But, working parents worry that there are not as many job opportunities available. 55% of parents with children under 18 agree that they have fewer job opportunities available to them in this economic environment, compared to 47% of employees without children under 18.

Personal Finance

Most employees worry that they will not get raises this year due to the looming recession and have therefore taken other actions to bolster their financial security.

With a looming recession, financial security is a topic that is top of mind for U.S. employees. Over half (56%) worry that they will not be getting a raise, while many (46%) even worry that they may see a reduction in their salary due to the looming recession. In fact, 9% say they have already taken a salary reduction due to the current economic environment.

Many sense a power shift between themselves and their employers, with over half saying they have less leverage to ask for a raise now than before this current economic cycle (55%), and also that they have less leverage in negotiating a salary at a new job now than before the downturn (55%).

Therefore, it’s no surprise that some U.S. employees are taking steps to better advocate for themselves, such as researching competitive salary ranges (20%) or comparing their salary with coworkers’ (16%).

Perhaps because of this income uncertainty, many have taken action with their own finances by reducing their spending (50%) and putting money into savings (38%).

In addition to adjusting their saving and spending habits, many have sought sources of supplementary income, with just over a quarter (27%) saying they have started a side gig or side hustle. This spark of entrepreneurship is most common among working women (32% vs. 23% of men). This trend shows that the next wave of exciting business formation may be on the horizon.

However, not all reported behavioral changes are positive – nearly one in three (31%) say they have had to take money out of savings due to the current economic environment.

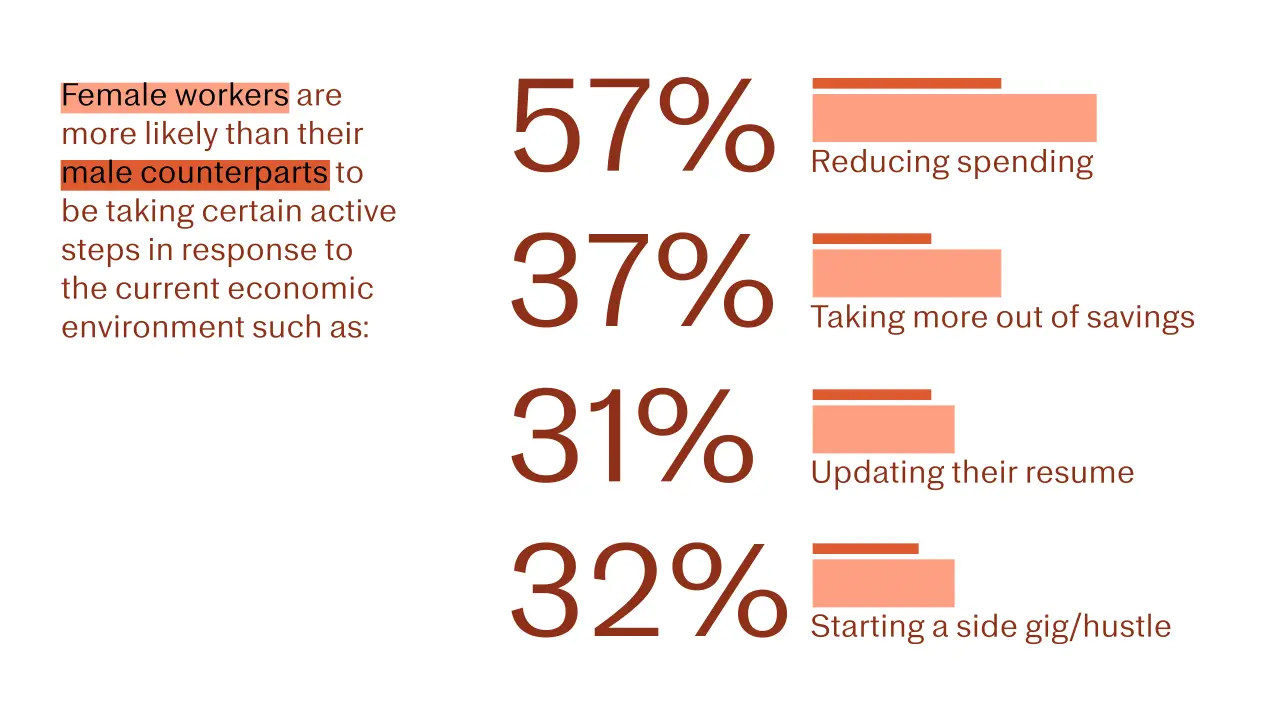

While both male and female workers are equally worried about various aspects of the looming recession, female workers are more likely than their male counterparts to be taking certain active steps in response to the current economic environment such as reducing spending (57% vs. 44%), taking money out of savings (37% vs. 25%), updating their resume (31% vs. 24%), starting a side gig/hustle (32% vs. 23%).

Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of Justworks from January 19-23, 2023 among 2,026 U.S. adults ages 18 and older including 1,099 respondents who are employed either full time or part time. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact press@justworks.com.